How to start with and establish Software Asset Management

SAM is a process not a tool

Software Asset Management (SAM) consists of everything an organization, that is using software from third parties, has to do for accomplishment of two goals:

- Every software that is installed or used is properly licensed according to the licensing terms of respective publisher (License Compliance).

- Investments into software licenses are optimized, considering actual needs and saving costs based on valid transparency (Cost Savings).

Obviously, both objectives correlate with each other. It is just the two sides of the same coin.

The key word above is "Valid Transparency". Control over license compliance and cost savings require that there is a management solution providing complete and accurate information about software in use, purchased licenses and how those records are reconciled with each other. It is simple as that, but in real life, this transparency does not fall from the sky. Actually, SAM requires validation, consolidation and aggregation of data from many sources. This is a challenge and requires quite some efforts. Before starting, however, it is essential to understand how to plan, how to proceed, how to organize and how to work on a daily basis.

This document provides a best practice recommendation for how to make your SAM program successful.

Many years of experience have shown that data quality and information content essentially depend on roles being filled and exercised responsibly, so that all relevant processes live sustainably and effectively. In a nutshell: 80% of a SAM program consist of standards, roles and processes while the SAM tool just facilitates your work with resulting information.

SAM project or SAM program? - Both!

First of all, it is important to understand that you cannot establish SAM as a "project" that ends at a certain point. Software Asset Management is just like financial accounting. The project "just" provides all the infrastructure and defines the rules for future perpetual operation. Accordingly it is essential to ensure that your SAM project is not only focusing on installing the SAM tool and providing the data interfaces to feed it. There is much more than this.

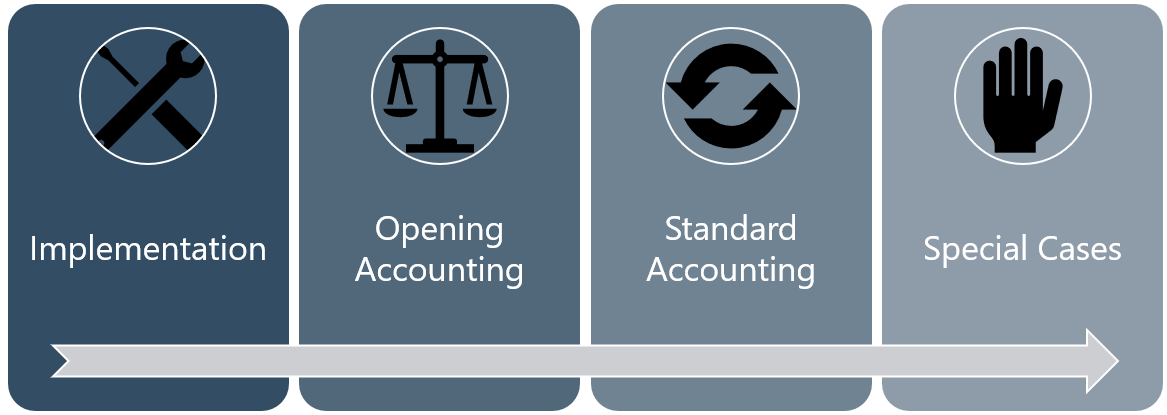

The different stages of your SAM program can be illustrated like this:

Implementation

In the implementation phase, all the prerequisites are created to operate Software Asset Management effectively and - that is important - with sustainability. This includes not only the project itself and the deployment of the SAM tool, but also the essential SAM foundation regarding standards, policies, roles, responsibilities and processes.

Implementation contains at least following major tasks:

- Setup the project, defining goals, milestones, budgets, procedures and the core team

- Define SAM standards, policies, roles and responsibilities as well as all required processes

- Establish continuous supply with master data about your organization (e.g. legal structure)

- Establish continuous supply of inventory data about your technical infrastructure (e.g. clients, mobile devices, servers)

For more information about SAM roles and responsibilities refer to article Roles and Responsibilities in SAM

Opening accounting

The opening accounting stage is as important as any other stage. But it is frequently underestimated or even skipped though. Make sure that you properly go through this phase with your activities along your SAM program. If you don't you will definitely suffer from inaccurate information, additional efforts, user frustration and possible even difficulties with acceptance from your management.

It might be hard to tell whether this stage is still part of the implementation project or already part of operations. In some way, it belongs to operation but show characteristics of a project - or better: of a recurring project that is meant to extend the standard accounting (SAM operations) step-by-step.

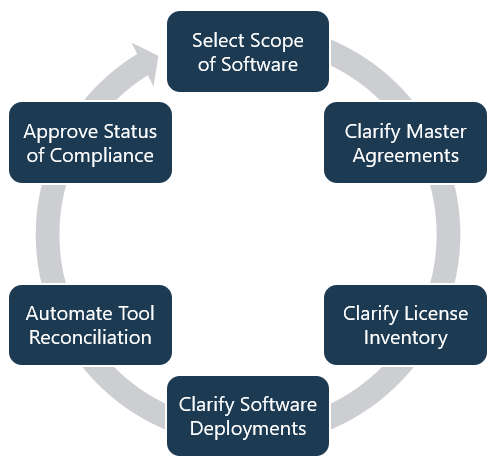

Recommended procedure:

|

|

Standard accounting (Operations)

In regular operations, the status of conformity approved in the opening balance sheet is frequently reviewed, verified and documented with a new baseline in the SAM tool.

The license inventory is updated, additional license purchases or contractually agreed notifications are planned and carried out. Authorization of additional software deployments are verified according to applicable corporate policies and standards.

Internal audits are planned and carried out, external requests for information and audits are processed.

Volume License Agreements are monitored over their lifetime. Any terminations, renewals or extensions are planned and prepared. As for execution, see information box below.

Volume License Agreements usually have significant impact on the licensing terms and metrics and thus on the configuration of the automatic SAM tool reconciliation engine. Any Closing, termination, renewal or amendment of an existing or a completely new Volume License Agreement should be addressed properly. The necessary procedure is very much the same as for the Opening Accounting, although not every step must be performed in the same depth. However, the SAM tool's configuration should be adjusted and produce correct results before you continue to run Standard Accounting for corresponding software in scope.

Special cases

Certain events are not handled in regular SAM operations because they affect the configuration of the automatic calculation function of the SAM Tool License Balance.

This includes:

- Relevant changes in the corporate structure (e.g. changes in affiliated companies).

- Changes in the Volume License Agreement that affect metrics or parameters that have been anchored in the automatic calculation (see chapter above).

- Significant changes in the provision of the software, e.g. initial provision on terminal servers or significant changes in the server data center.

These special cases are treated in the same procedure as the Opening Accounting.